Prepare for funding: Cover your risks

Part 4: It’s time to identify and manage your risks

By Tanya Wong

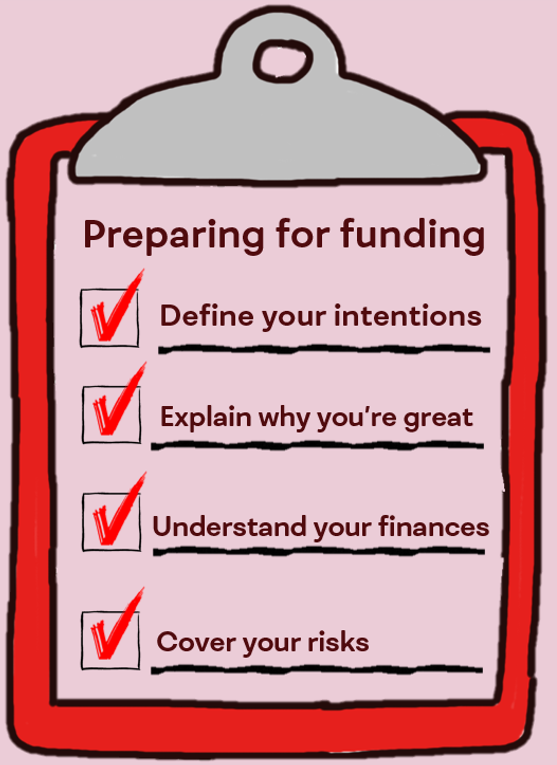

In the last of our four-part series to prepare you for funding, we’re looking at risk. How do you identify and manage your risks in a way that reassures lenders and funders their investment is safe?

Lenders and investors are always very concerned about risk – and it’s easy to see why. They want to know they’re committing their money to an organisation that will use it responsibly and for the most impact. And it’s not just about the money – your approach to risk creates a perception about how responsible you are, and therefore how well your organisation is managed.

This doesn’t mean you have to avoid all risks if you want to be successful in getting funding. Risks are an inevitable part of life, and it’s impossible to safeguard against everything. But if you show you understand and manage your risks as much as possible, potential funders and investors will take you more seriously. It will also help you safeguard your organisation in the long-term and likely get better outcomes.

What are your biggest risks?

Before you start speaking to potential investors, take some time to consider the main things that could go wrong. These are usually the things that are either most likely to happen or the things that could cause the largest damage to your organisation (or both!).

Hopefully by evaluating your people and finances you will have already identified any potential risks there – and thought of ways to mitigate them. Another area to consider are risks to your organisation’s impact. What might get in the way of your outcomes and ability to deliver on your vision and goals?

Risks could include:

· Uncertainty-based risks such as key person or succession issues – what if the skilled people in your organisation leave – who will replace them?

· Opportunity-based risks such as rapid growth – what happens if your organisation needs to increase capacity quickly. Will your systems and processes cope?

· Hazard-based risks such as potential liability – what if someone was injured or otherwise negatively impacted by your organisation?

Once you have identified the potential risks, look at what you have done – or could do – to mitigate them as much as you can. Make sure these are clearly expressed so anyone evaluating your organisation can see that you’re aware of the potential risks and are taking the necessary steps to reduce or at least manage them.

Proactive risk management

One organisation that does risk management well is environmental social enterprise Wildlife Wonders – an ecotourism organisation that invests its operating surplus into conservation. Their ethos is ‘do it slowly but properly.’

When they approached us, we were impressed by their transparency when it came to risks. Their management were aware of some subject matters they weren’t familiar with and were keen to bring advisors and supporters on board to help fill their knowledge gaps. They were also comprehensive in planning, conducting sensitivity analysis, formulating backup plans, and building contingencies into all their budgets.

By getting a handle on your purpose , operational capabilities, finances and risks you can position your organisation better to appeal to potential funders and investors. And with flexible, tailored solutions, Sefa can help you every step of the way as you prepare for funding, build your capacity and increase impact in the communities you help.

Are you ready to get started? Get in touch with us today.